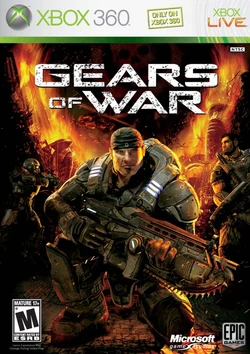

Gears of War

Autres actions

- Xbox 360

- PC Game for Windows LIVE

- Xbox 360 : 7 Novembre 2006 (US), 17 Novembre 2006 (Europe) et 18 Janvier 2007 (Japon)

- PC : 6 Novembre 2007 (US) et le 9 (Europe)

- Pegi 18

- ESRB M

- Hors-Ligne

- Campagne : 1 à 2 joueurs

- Multijoueur : 1 à 2 joueurs

- Multi-console

- Xbox-Live

- 1 à 2 joueurs en campagne (1 joueur par console )

- 2 à 8 joueurs (1 à 2j par console)

- Xbox 360 : 94/100

- PC : 87/100

Gears of War est un jeu vidéo de tir à la troisième personne et le premier de la licence Gears of War. Initialement sorti sur Xbox 360 en novembre 2006, il a été annoncé à l'E3 de 2005.[1][2]

Le jeu propose un mode histoire jouable en solo ou en coopération à deux et un mode multijoueur.[3]

La suite du jeu, Gears of War 2, est sortie en en 2008, suivi de Gears of War 3 en 2011 qui clôture l'arc narratif débuté dans le premier opus.

En 2015, une version remasterisée nommée Gears of War Ultimate Edition est sortie sur Xbox One et Windows 10.[4] Puis le 26 août 2025 ce remaster à été porté sous le nom de Gears of War Reloaded sur Xbox Series, Windows 10, Steam et pour la première fois de la licence sur Play Station 5 avec le crossplay entre toutes ces plateformes et diverses améliorations graphiques

Gameplay

Armes

|

|

|

Véhicules

|

|

|

Equipements

Campagne

Personnages

|

|

|

|

|

Ennemis

|

|

|

Scénario

Niveaux

Multijoueur

Cartes

Succès

- Voir : Succès de Gears of war 1

Musiques

Easter eggs

Diffusion

Édition Spéciale

DLC et extension

Rétrocompatibilité

Développements

Crédits

Marketing

Réception

Critiques

Ventes

Statistiques

Distinction

Vidéo

Liens

Sources